전문가들이 제공하는 다양한 정보

Tax Benefits: Leveraging Tax Advantages In An Operating Lease

페이지 정보

본문

1. Depreciation Deduction: When a business leases tools, they can typically deduct the cost of the lease funds as a business expense. Additionally, they may be able to claim a depreciation deduction on the value of the leased tools. This deduction can help offset the cost of the lease funds and cut back the enterprise's taxable earnings. This allows for much less danger to the lessee, whereas also being cost-useful. Usually, leases also present extra sustainable monthly funds, which is favorable for smaller companies that could be unable to establish their portfolio with such assets financially. As such, lease terms are sometimes contracted only for the amount of time you might make the most of the asset, saving cash long run. An awesome profit to an working lease is that it grants businesses the chance to upgrade or replace assets or take advantage of short-time period utilization for business operations.

Nonetheless, this also implies that the lessee should embody the asset's worth of their balance sheet, potentially affecting financial ratios and borrowing capacity. From a tax authority's viewpoint, the classification of a lease as capital or operating can affect authorities revenues. Nonetheless, over the life of the asset, the total deductions may be comparable, simply timed otherwise compared to working leases. For companies, understanding the tax implications of capital leases is crucial for efficient financial planning and management. Suitability for stable property: It’s ideal for property that depreciate steadily over time, reminiscent of buildings or furniture. Whereas the straight-line methodology is extensively used, it’s vital to pay attention to its limitations. It may not precisely reflect the depreciation sample of property that lose value more shortly in the early years. By specializing in key areas reminiscent of flexibility, cost, and asset preservation, and by being prepared with concrete examples and well-researched information, events can enter negotiations with confidence and the tools necessary to succeed in a mutually beneficial agreement. In the case of lease negotiation, the choice between a monetary lease and an working lease is pivotal and might have lengthy-lasting implications for what you are promoting.

The lessor recognizes lease revenue on a straight-line basis over the lease term, regardless of the timing of actual rental receipts. Working lease assets are tested periodically for impairment. Underneath IFRS 16, lessees now acknowledge proper-of-use property and lease liabilities on the steadiness sheet for many leases. At lease graduation, the lessee records a proper-of-use asset and lease legal responsibility primarily based on the present value of future lease funds.

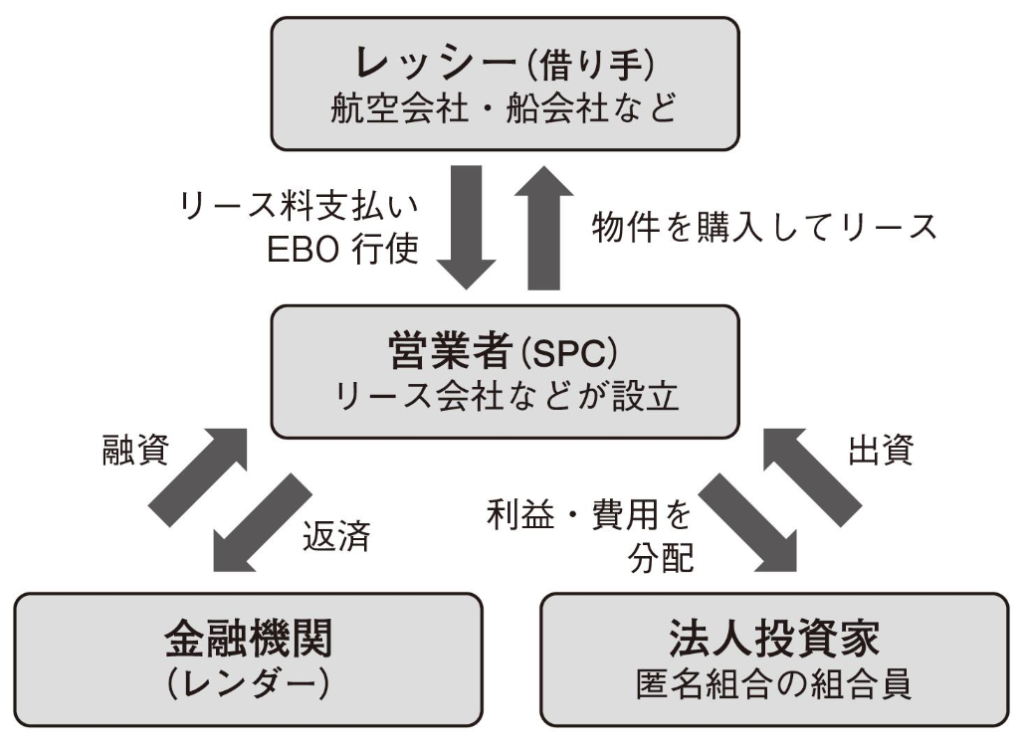

Lessees should absolutely disclose all data that might be pertinent to the lessor’s willingness to lease the aircraft pursuant to what’s been proposed in the time period sheet. The financing proposed within the term sheet must be practical and more likely to be authorized by the lessor’s credit committee properly earlier than the scheduled closing. In this situation, it's essential to outline a set property posting profile to submit to the fitting-of-use asset account. The curiosity for a lease is acknowledged by calculating curiosity for the lease’s starting steadiness, interval lease payment, interest borrowing price, and compound interval periods per year. The interest amount increases the operating lease liability account by crediting it, which might be mirrored on the organization’s balance sheet. In this video, we delve into the complexity of - Asset leasing module in Microsoft Dynamics 365 Finance. We are going to give attention to lease adjustments and why they matter. Lease changes can come up from changes in lease terms, オペレーティングリース リスク extensions, or other circumstances, and understanding find out how to navigate them is essential for monetary readability in Dynamics 365 Finance.

- 이전글The most important Downside in Daycares Popular Listings Comes Down to This Word That Begins With "W" 24.12.28

- 다음글Why Nobody is Talking About Daycare Near Me And What You Should Do Today 24.12.28

댓글목록

등록된 댓글이 없습니다.